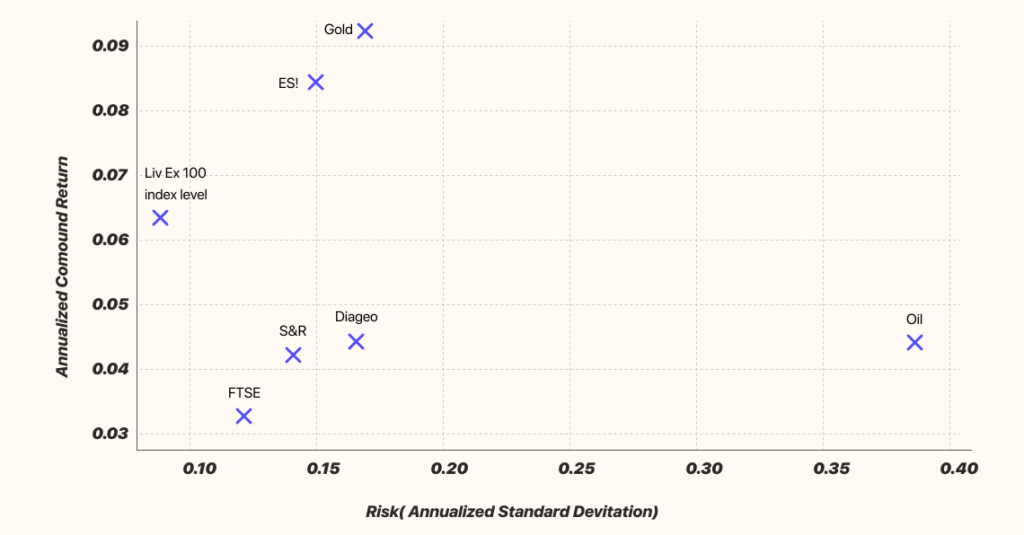

The average monthly return for the “Liv Ex 100” index is approximately 0.53%. When annualized, this translates to an average annual return of about 6.55%.

To analyze the performance of the new “Liv Ex 100” dataset, I’ll perform the following steps:

- Descriptive Statistics: Evaluate basic statistics like mean, median, standard deviation, etc.

- Trend Analysis: Visualize the trend over time (already done).

- Returns Analysis: Evaluate the monthly and cumulative returns.

- Volatility Analysis: Measure the volatility of returns.

- Performance Metrics: Calculate key metrics like cumulative return, average monthly return, and annual return.

I’ll proceed with these steps now.

Performance Analysis of the “Liv Ex 100” Dataset:

Descriptive Statistics:

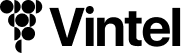

- Mean Index Level: 269.67

- Standard Deviation of Index Level: 82.94

- Minimum Index Level: 96.46

- Maximum Index Level: 424.35

Returns Analysis:

- Average Monthly Return: 0.53%

- Annualized Return: 6.55%

- Volatility (Monthly): 2.39%

- Annualized Volatility: 8.28%

- Cumulative Return: 244.32% (from the start to the end of the dataset)

Live Ex 100 Index Level Over Time

Key Observations:

- The dataset indicates consistent growth with an average annual return of 6.55%, which is solid over a long period.

- The monthly volatility is relatively low, translating to a modest annualized volatility of 8.28%, suggesting that the index is relatively stable.

- The cumulative return is significant, reflecting substantial growth over the time period covered in the dataset.

Risk vs. Return (Annualized Compound Return vs. Volatility)