CORRELATION

& VOLATILITY

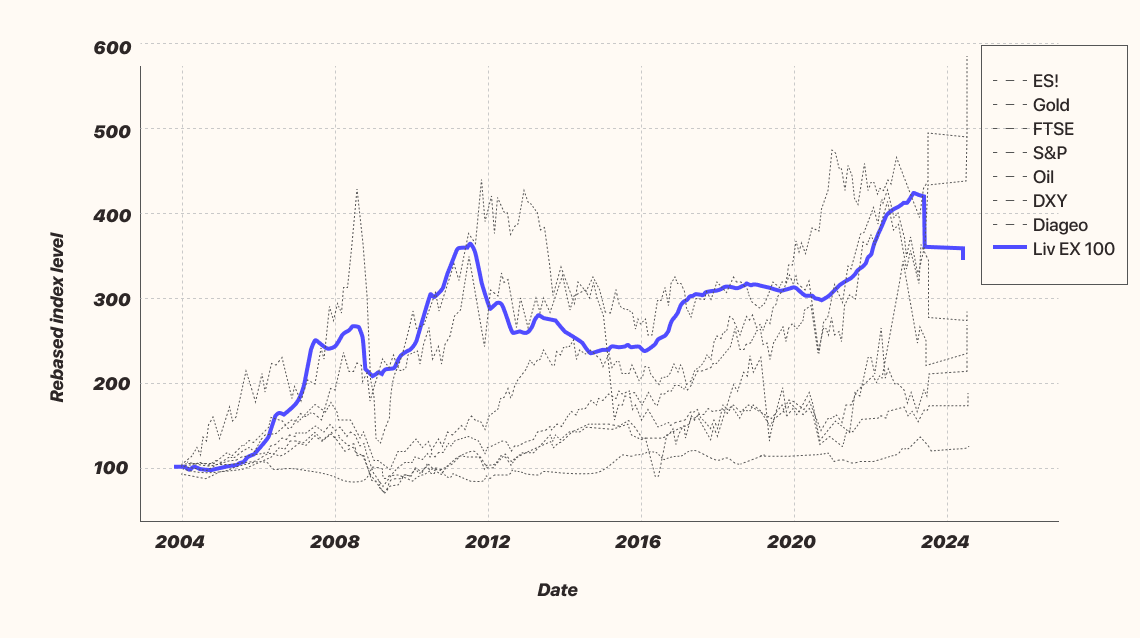

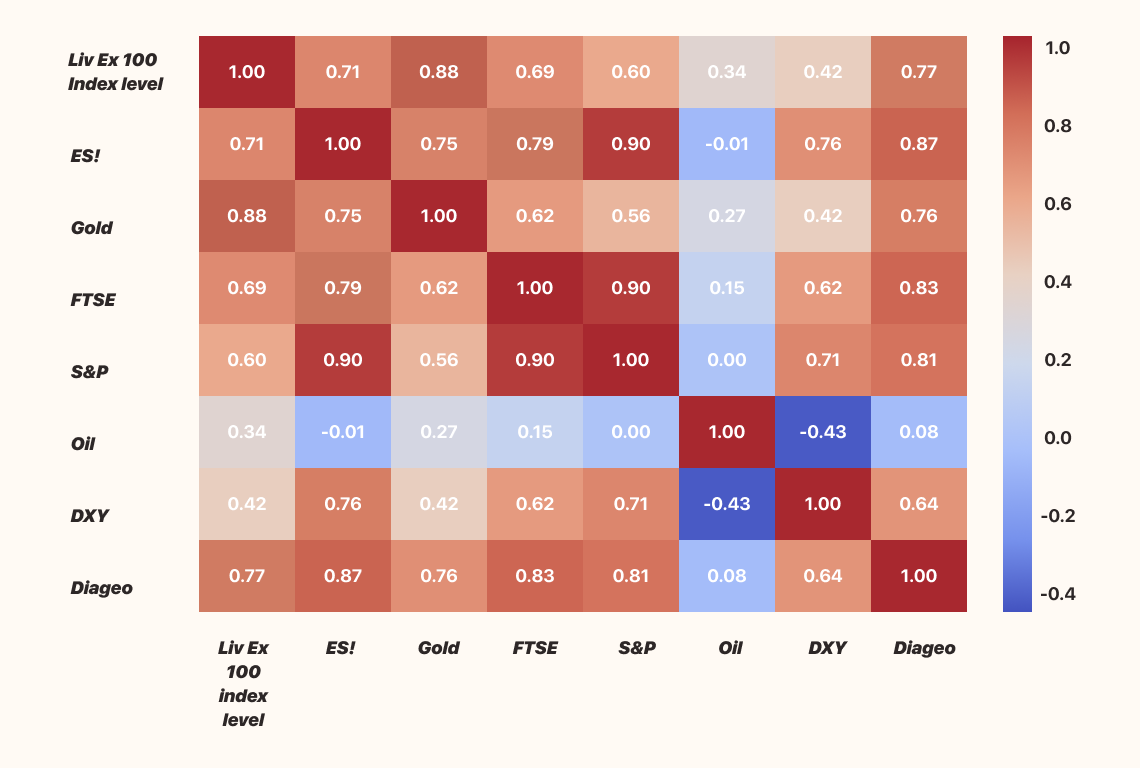

The correlation matrix shows how each index or asset is related to the others. Values close to 1 indicate a strong positive correlation, while values close to -1 indicate a strong negative correlation.

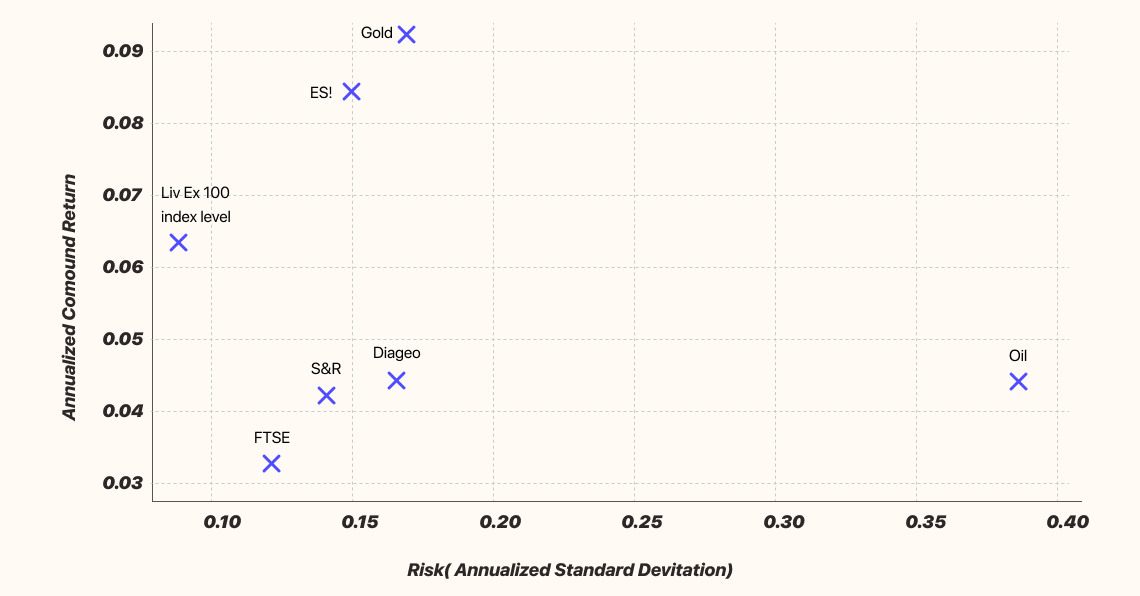

Volatility

The volatility (annualized standard deviation of returns) indicates the risk associated with each index or asset.

| Liv Ex 100 |

1 |

0.71 |

0.879 |

0.694 |

0.597 |

0.343 |

0.418 |

0.772 |

| ES! |

0.71 |

1 |

0.752 |

0.788 |

0.897 |

-0.014 |

0.765 |

0.874 |

| Gold |

0.879 |

0.752 |

1 |

0.622 |

0.564 |

0.274 |

0.423 |

0.756 |

| FTSE |

0.694 |

0.788 |

0.622 |

1 |

0.903 |

0.15 |

0.616 |

0.831 |

| S&P |

0.597 |

0.897 |

0.564 |

0.903 |

1 |

0.002 |

0.705 |

0.814 |

| Oil |

0.343 |

-0.014 |

0.274 |

0.15 |

0.002 |

1 |

-0.431 |

0.083 |

| DXY |

0.418 |

0.765 |

0.423 |

0.616 |

0.705 |

-0.431 |

1 |

0.64 |

| Diageo |

0.772 |

0.874 |

0.756 |

0.831 |

0.814 |

0.083 |

0.64 |

1 |

Key Insights:

- Liv

Ex 100 shows a relatively strong correlation with Gold and Diageo, suggesting these assets move in a somewhat similar

direction.

- Oil has

the lowest correlation with the other indices, indicating it behaves quite

independently.

- Oil also has the highest volatility, making it the most volatile asset among

those listed.