When compared to other commodities and financial

markets, fine wine has shown competitive returns with lower volatility:

Comparison with Other Assets (2002 to Present):

Analysis of Total

Performance and CAGR

Cumulative Return (%)

Annualized Return (%) / CAGR (%)

Volatility (%)

Sharpe Ratio

Conclusion: Liv-ex 100's Strengths

The Sharpe Ratio is a financial metric used to

evaluate the risk-adjusted return of an investment or portfolio.

Volatility refers to the degree of variation in

the price of a financial instrument over time. It is often used as a measure of

the risk associated with an asset's price movements.

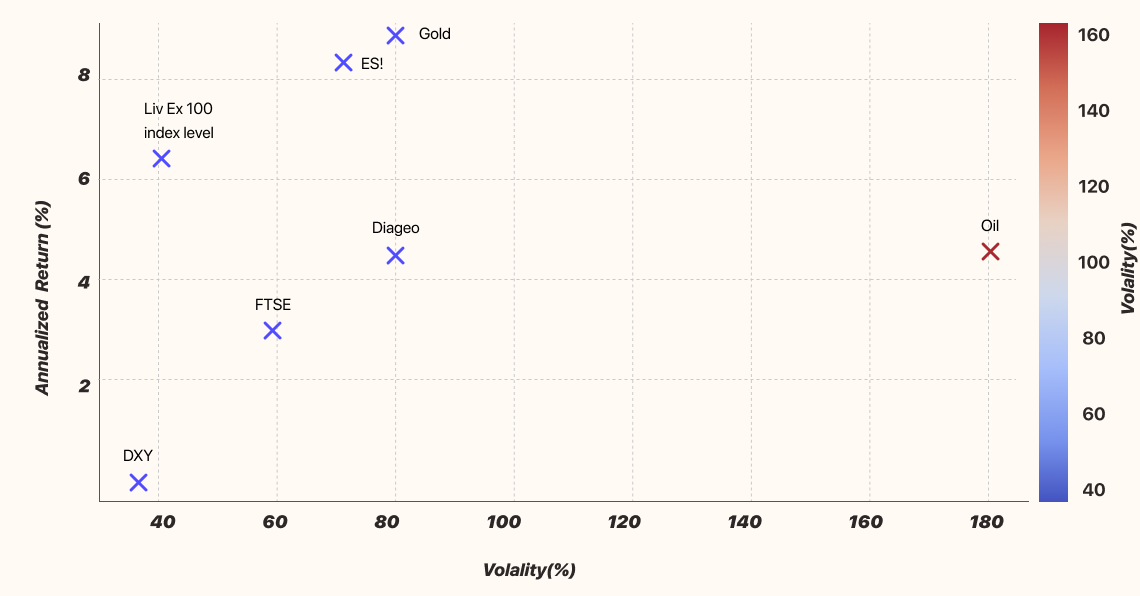

Risk vs Return: Annualized Return vs Volatility

The Risk vs Return graph highlights Liv

Ex 100 as a strong performer, delivering a 6.4% annualized return with

relatively low volatility (37.9%). Compared to higher-risk assets like Oil, Gold, and ES!, which have greater volatility, Liv Ex 100 offers a more stable investment with competitive returns. Its strength lies in

balancing strong returns with lower risk, making it an appealing option for

investors seeking growth with moderate volatility.

Fine wine's unique position as a tangible,

scarce asset with consistent demand makes it a valuable addition to a

diversified investment portfolio. Its lower volatility and strong performance

over time offer a compelling case for investors seeking stability and growth.

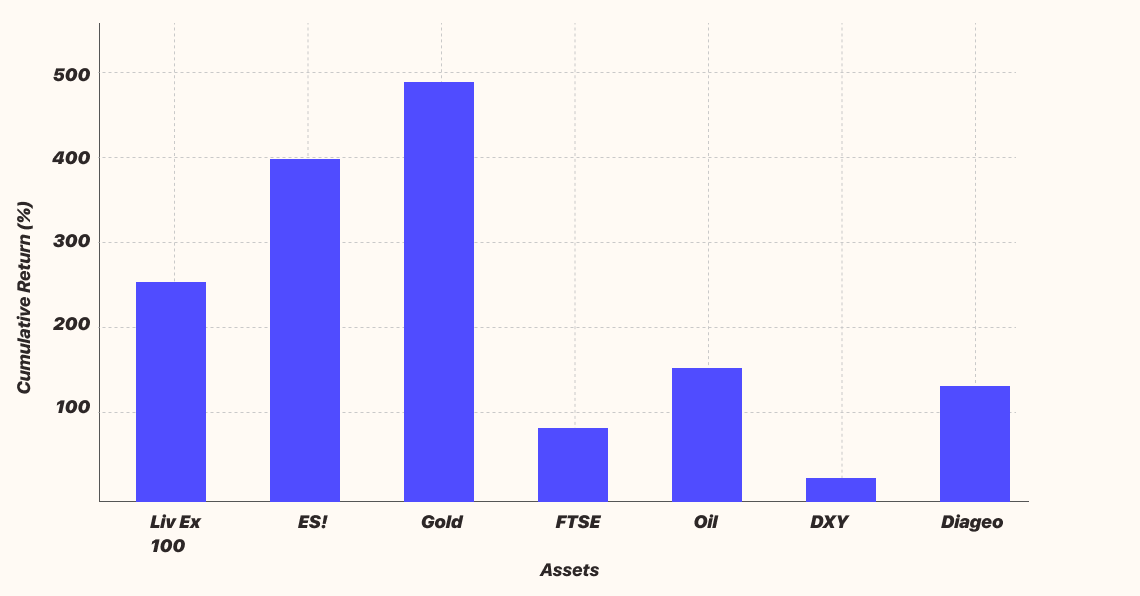

Cumulative Return Comparison

The Cumulative Return Comparison chart highlights that Liv Ex 100 has a cumulative return of 244.3%,

placing it behind ES! (400.5%) and Gold (488.9%), but

significantly outperforming other traditional assets like FTSE (86.9%)

and DXY (19.7%).

Liv Ex 100's strength lies in its ability to generate strong returns while maintaining

lower volatility compared to highly fluctuating assets like Oil (141.5%

cumulative return, but with extreme volatility). Its return is solid, and it

offers a more stable investment choice than many high-risk, high-reward

options, positioning it as an attractive middle ground for investors seeking

both growth and risk moderation.

Conclusion

Fine wine investment provides a unique

opportunity for diversification, offering high returns with lower risk compared

to conventional markets. With its proven track record, limited supply, and

increasing global demand, fine wine is positioned to remain a robust and

attractive asset class. By carefully selecting investment-grade wines,

utilizing proper storage solutions, and understanding the market dynamics,

investors can enjoy the potential of fine wine as a long-term wealth-preserving

investment.

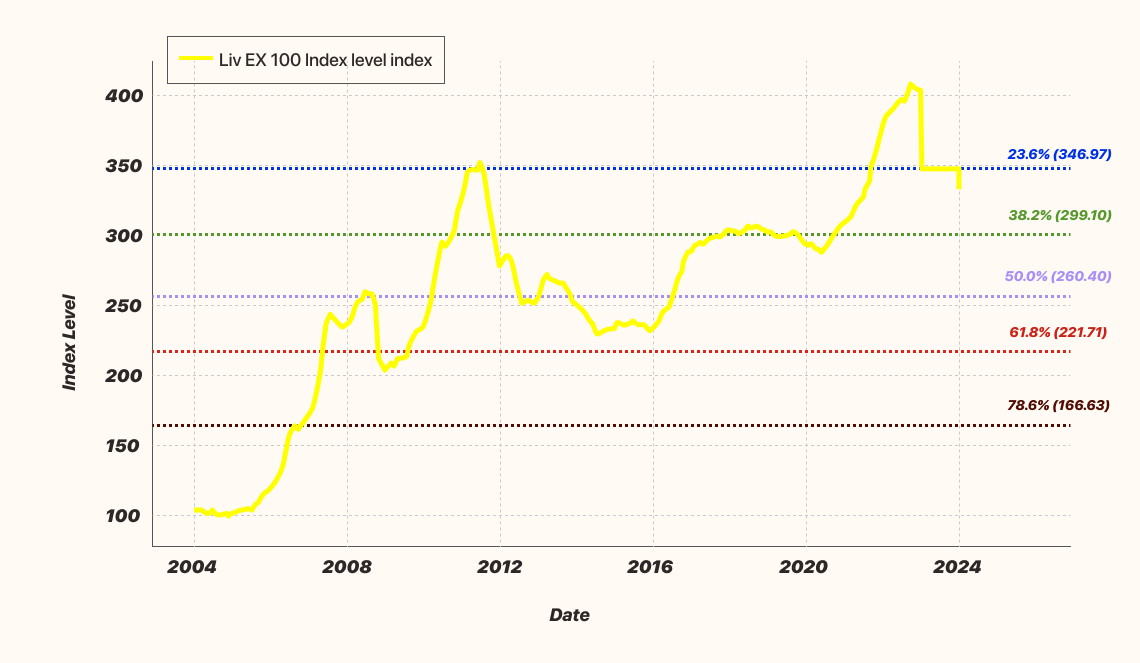

Liv Ex 100 Index Level Over Time

Liv Ex 100 Index: Performance with Labeled Fibonacci Levels